ABOUT THE NEW ELLIOTT WAVE RULE

What is the new (4th) rule?

Wave 5 of an impulse wave may have 3 waves instead of 5 waves.

How should the new waves be labelled?

Since the new wave consists of 3 waves, it should be labelled as an A-B-C to conform to the Elliott Wave labeling logic.

Does the 4th rule happen all the time?

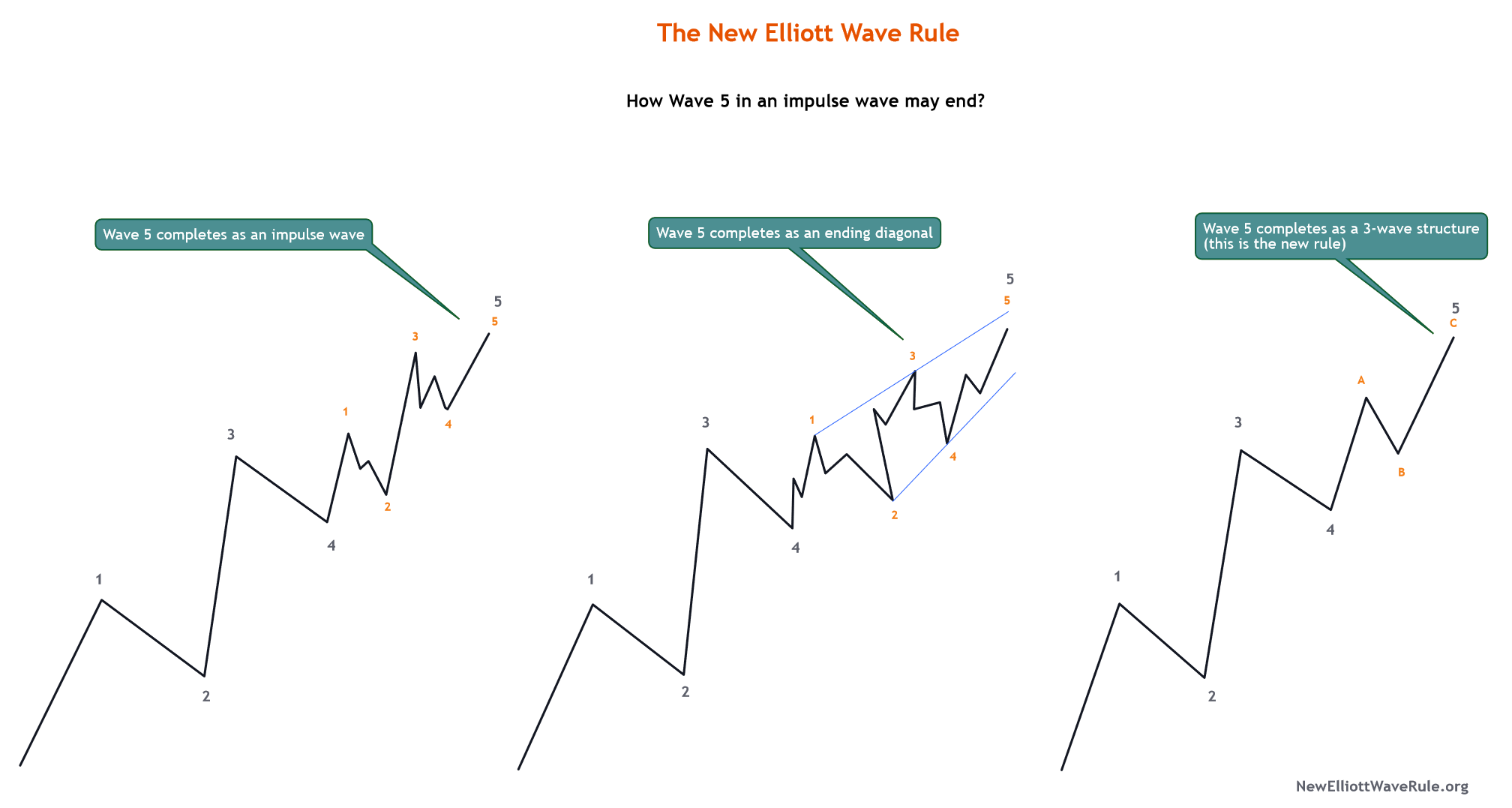

No. It is one of the three possible scenarios of wave 5. In an impulse wave, wave 5 may end in one of the following ways:

- As an impulse wave

- As an ending diagonal

- As a 3-wave structure that meets the 4th rule requirements (this is the new rule)

All the possibilities are illustrated below:

Why is it a useful rule?

The new rule:

- Eliminates the need for unnecessary labels (corrective waves: A, B, C, W, X, Y, Z and ending diagonal waves)

- The guideline of a truncated 5th wave is no longer required to follow

- Allows to simplify the wave count and overall wave structures by minimizing alternative counts

Isn't the new 3-wave structure similar to an ending diagonal?

It is similar in only one aspect: all waves of an ending diagonal are supposed to be corrective (mostly zigzags or double zigzags). However, an ending diagonal, just like an impulse wave, has 5 waves; the new structure is composed of only 3 waves.

Can the new rule be applied to all markets and time frames?

Yes. According to Elliott Wave, the market is fractal, meaning that the same patterns and wave structures constantly appear and repeat in all time frames. The new rule, just like the other rules, can be applied to all motive waves (ie. impulse waves and ending diagonals) in all markets and time frames.

Should traders be cautious when applying the 4th rule in real markets?

Yes. The main reason is that the primary wave (one of a lower degree) may become wave 1 or wave 5 of a diagonal. Subwave 5 should still be "locally ending" (ie. the next expected move is supposed to be in the opposite direction of the trend), but due to the different natures of a diagonal vs. an impulse wave, one should always be careful and be ready for different outcomes.

ABOUT ELLIOTT WAVE RULES, GUIDELINES, USEFUL TIPS, AND TRADING STRATEGY

What is Elliott Wave?

Elliott Wave is a technical analysis tool discovered by Ralph Nelson Elliott in 1940-ties. It is based on human psychology and Fibonacci numbers.

The basic concept is that all price movements have two modes: motive and corrective. The motive mode always determines the trend and is always composed of 5 waves and a corrective mode is always composed of 3 waves. There are two types of motive waves: an impulse wave and an ending diagonal. There are four types of corrective waves: zigzags, flats, triangles, combinations.

What are the three cardinal (original) rules of Elliott Wave?

There are only three rules:

- Wave 2 never retraces more than 100% of wave 1

- Wave 3 is never the shortest motive wave (which always has 5 waves)

- Wave 4 never ends in the price territory of wave 1

Can Elliott Wave rules be ignored?

No. Rules can never be ignored. If a single rule is broken, the whole wave pattern or structure becomes invalid and requires a recount. On the other hand, Elliott Wave guidelines may be ignored, but it is recommended to always follow them too.

Will there be more Elliott Wave rules introduced in the future?

It's unlikely that totally new rules will be adapted because that would have to change too many working parts. However, new guidelines may be discovered and some old ones may be modified or abandoned.

How many Elliott Wave guidelines are there?

Nobody really knows the exact number. Over the years, some old guidelines have depreciated, and new ones have been added. There are a dozen or so well established guidelines and possibly up to 50 that are not common knowledge.

Which Elliott Wave guideline is the most important?

"The right look" guideline is probably the most universal because it can make or break a wave structure. If a wave pattern's proportions are out of balance in price or in time, the pattern may be incomplete or be different from what was expected.

What is the best way of learning Elliott Wave?

Here is some advice to Elliott Wave students:

- Remember that the Elliott Wave principle is just a tool to help you make profitable trades, nothing else

- Learn all the rules and as many guidelines as you can find

- Use a candlestick chart and a the semi-log scale for the highest accuracy

- Get familiar with wave labeling tools because precise forecasting requires frequent relabeling and constant process of "zooming in" or "zooming out"

- Always start counting waves from the extreme (high / low) pivot points

- Don't procrastinate applying what you've learned to real price charts

- Label charts yourself before verifying them against other analyses or wave counting software

- Practice wave labeling with both the bullish and the bearish trend

- Anticipate simple wave structures before complex wave formations

- Follow the guideline of wave truncations only as a last resort because they are very rare

- Analyze the work of seasoned Elliott Wave technicians

- Don't get discouraged if your price action forecast turns out inaccurate (it happens to all of us)

- Don't trade against the primary trend if you are an inexperienced Elliott Wave trader

- Any given pattern will almost always end later than you had originally assumed it would

- It's worth watching momentum indicators like RSI, Stochastic, or Directional Movement Index (DMI) where basic Elliott Waves are present

- Contrary to logic, the more experienced an Elliott Wave analyst is, the less alternate wave counts he or she will offer because multiple scenarios mean less assurance of the right forecast

Can Elliott Wave help in trading?

It surely can as any other form of technical analysis. Keep in mind, though, that it may take years of active study and trading to become proficient in Elliott Wave. Memorizing the rules and guidelines is an easy part; what most technical traders struggle with is applying the wave principle to real charts. Elliott wave count software may speed up the process, but it is not recommended to use it in real trading environments.

Does Elliott Wave work today as well as years ago when it was first discovered?

It depends on how we measure the theory's performance. It is true that the more popular a trading strategy is, the less effective it may become over time. If a strategy is based on a theory that has been adapted by many traders and trading software, it may not be as effective as when it was unknown. That's why, most theories evolve and become more complex, mainly through new or modified guidelines, to remain relevant and competitive.

Is Elliott Wave different than price action trading?

When applied correctly, price action, just like the Elliott Wave theory, is fractal and works in all time frames. While price action tells what exactly is happening in the market, the wave theory also tries to forecast what may happen in the future. In most instances, the terms of "price action" and "wave theory" may be used interchangeably.

If you're looking for a price action expert who has been using the wave theories (both Elliott Wave, Harmonic Wave, NeoWave, and possibly other variations) as his dominant analysis tool, visit PriceActionHelp.com.

Is Elliott Wave too "subjective" to work with?

There is a lot of misconception about Elliott Wave, even among trading professionals who are familiar with it.

The following are my tips and thoughts on what Elliott Wave is and what it is not:

- Elliott Wave is supposed to "subjective." It is not an automated tool; if it was, it would not require any analysis

- Not everyone can learn to accurately apply the wave theory on live charts because it is a very difficult skill to learn that requires years of experience

- Just like in any trade, only competent Elliotticians can reap the full benefits of the tool

- It is expected for two Elliott Wave technicians to agree on a primary trend (bullish vs bearish), but disagree on the exact structure of a lower degree pattern

- The best way of learning the Elliott Wave theory is by studying price action and labeling charts in various markets

- Adhering to the Elliott Wave guidelines is required to make chart labeling accurate

- Not all market structures conform to the idealized Elliott Waves; not all price movements can be explained using the classic wave theory

- Having an alternate wave count works to the trader's advantage, not a disadvantage

- Recognizing a wave pattern doesn't create a potential trade because the pattern can be incomplete

- It always pays off to take into account the fractal nature of the wave theory and see the whole picture (on a weekly / monthly time frame)

- It is possible, but not easy, to devise a trading plan solely based on Elliott Wave and Fibonacci numbers

- The more historic data is available, the more accurate Elliott Wave forecast may be

- Fibonacci ratios, extensions, cycles, dividers, and numbers are just possible price target which may not happen

- If a wave count looks too "clean," it often suggests an upcoming unexpected or complex pattern development

- Technical indicators don't always align with Elliott Wave patterns, so a proper balance needs to be built and maintained

- Except for specific scenarios, volume is not a very accurate signal in Elliott Wave

- It's impossible to be 100% certain about a larger pattern from two or three waves because of too many possibilities

- A new low or high can be achieved both through a motive wave and a correction pattern

- Never ignore candlestick wicks when counting or labeling waves because they are an important part of price action analysis

- Elliott Wave corrections frequently last longer than expected

- A 3-wave move is not always corrective just like a 5-wave move is not always impulsive

- Momentum divergence may be helpful in recognizing wave 3 vs wave 5 (in an impulse) and wave A vs wave C (in a correction)

- As opposed to a line chart, a candlestick or an OHLC chart are preferable when working with Elliott Wave

- The Elliott Wave guidelines are as important as the rules because they make or break a wave pattern

- Hypothetical areas of a starting or an ending point of a wave pattern is not a suggested way of managing risk in trading

- Wave extensions and corrections tend to be the weakest point in a mediocre wave count

- Corrections in Elliott Wave almost always take more time than related impulse waves or diagonals

- Impulse waves tend to stay outside a corrective channel; corrective waves are bound by a corrective channel

- When you can count 5 waves from an extreme high or low, don't immediately speculate the structure is going to be a trending motive wave

- Since any of the five impulse waves can extend, don't assume that counting 5 waves means a reversal

- Elliott Wave triangles can be tricky; it's best to avoid trading them unless the wave A / wave C trendline of a triangle is broken on a daily chart

- Elliott Wave patterns are very often broken by trend channels and trendlines (but it doesn't mean the patterns are wrong)

- Trading using the Elliott Wave principle can be the most successful when working with (not against) the main trend

- Trading corrective waves is never a good idea, no matter how compelling price action may seem

- If you are a conservative trader, it's best to assume wave 5 will never happen and focus on trading wave 1 or wave 3

- Always have an alternate wave count ready in case your primary count gets invalidated

- The end of a pattern or a pattern's subwave often coincides with a major news event

- Automated Elliott Wave count software is never going to be as reliable as a master Elliott Wave analyst

- Don't be a biased trader; if Elliott Wave / price action supports a given move, but it contradicts the news, stick to technical analysis because mainstream news is a lagging indicator

For more information about the Elliott Wave Theory, revised Elliott Wave rules and guidelines, refer to: https://priceactionhelp.com/elliott-wave.

... It's not how you start an Elliott Wave count that's important, but how you finish!